Non-Fungible Token (NFT) has emerged as the key player in the blockchain market. As a result, you can easily find an NFT crypto project to invest in these days. Since 2021, when several digital artworks and memes were auctioned and sold for hundreds of thousands to millions of dollars, people have been increasingly drawn to NFTs. Additionally, video games based on NFTs such as Axie Infinity have become more mainstream, with more startups and established developers launching their NFT-based game titles. So far, so good! However, some investors and experts still raise doubts regarding their fair use, legitimacy, and most importantly, control. Here are some key advantages and disadvantages of NFT you should know.

Advantages of NFT

As the world undergoes another digital transformation, non-fungible token proves why it’s the next go-to place for streamers, artists, and gamers. The token itself is a digital asset that enhances the security for digital data residing across the World Wide Web. Let’s look at what gamers, streamers, and artists can reap from NFT projects.

1. Unique Ownership

Non-fungible digital collectibles create a feeling of uniqueness and exclusivity. This can be seen with items such as paintings, furniture, and digital images. In addition, audio clips and other digital assets can also be considered non-fungible, making them special, i.e., one-of-a-kind.

2. Licensing Digital Assets

Converting a digital file, such as an image or video clip, into an NTF is like granting it licenses for authenticity and ownership. It also opens up the possibility to transfer ownership or rights to use, distribute, or even sell to other parties. NFTs are one-of-a-kind digital assets that cannot be easily duplicated or endlessly copied.

Furthermore, each non-fungible token has a distinct value because it exists on a decentralized and public digital ledger based on blockchain technology. The buzz around NFTs is all about tokenization. This innovative technology provides a solution for digital content creators, including music producers and software developers, to license their work and turn it into a unique digital asset.

3. Profit Generation

Digital art is gaining popularity, and one of the reasons is that it can be monetized. Non-fungible tokens are the perfect way to assign a monetary value to digital artwork, and this is their first early use case. Michael Joseph Winkelmann, also known as Beeple, sold his digital artwork “Everydays—The First 5000 Days” for $69.3 million in March 2021.

Likewise, Kristy Kim’s 3D-rendered house model “Mars House” sold for $500,000. Some most popular internet memes have also been digital assets. These include the Charlie Bit My Finger viral video clip, the Disaster Girl meme, and the Nyan Cat YouTube video. Moreover, the popular Doge meme was sold for a whopping USD 4 million in June 2021.

4. Fundraising

Several companies have launched innovative digital collectible products. For example, physical collectibles such as baseball and NBA cards have been turned into digital assets with unique identifiers and represented as non-fungible tokens. NFT minting can also be used to raise funds by auctioning off digital creations, such as films and literature, digital collectibles, and other digital content which can be used for charity.

Documents, such as contracts and patents, can also be tokenized and auctioned off. Blockchain gaming is on the rise with NFTs at the forefront, too. These digital assets can represent anything from in-game lands to playable characters and items. Tokenizing these assets can provide the foundation for developing new and innovative gaming experiences.

5. Better Trading Option

The digital world provides a unique way to create scarcity and value for assets. By turning files into unique tokens, we can create a system where the availability of these assets is limited, driving up the value for anyone looking to acquire them. Numerous individuals have acquired NFTs to express their creativity, just as they would with physical artworks.

Or, they may be anticipating that the value of these digital assets will increase in the future and thus see them as a sound investment. Whatever the reason, the potential for profits through investing or trading is an advantage of purchasing an NFT. For example, CryptoPunk #3100 was first sold for $2127 in 2017. When sold to another collector in 2021, the original collector generated more than USD 7.5 million on investment return.

6. Collectables

NFTs are non-fungible tokens, meaning they cannot be traded for one another, as no two NFTs have the exact same value. Then, why are they so in demand? Because just like art, while most people might not understand, it has a certain collection value. Now, we are not saying this value has to be monetary. It can be sentimental, social, or purely amusing, but NFTs are considered a niche collectable item. When Twitter’s co-founder Jack Dorsey sold his first-ever tweet as an NFT for $2.9 million, the buyers didn’t purchase the tokens due to their monetary value.

Disadvantages of NFT

NFTs are the next big thing in the world of crypto. However, while they offer a lot of potentials, there are some significant drawbacks that investors need to be aware of. Some most significant downsides of NFT are listed below.

1. Exact Value of NFT is Difficult to Predict

NFTs can be confusing for experts and newcomers alike. When you purchase one of these non-fungibles, you’re not just buying a digital asset, but also purchasing a piece of art history. Though you own this unique token, people can find copies of the corresponding art all over the internet.

Simply put, nothing seems to stop them from copying and showcasing those files on social media, essentially showing off, despite the fact you have invested largely into that NFT art. What’s the value of an asset that’s not under your control? Depending on how collectors find an answer to this in the future, those who invested already into NFTs may be left holding a digital record that’s not worth enough.

2. Environmental Concerns

The environmental concern of NFTs is a buzzing topic of debate now. For example, any record entered into the Ethereum blockchain is a permanent and public record that takes significant computing power, requiring substantial amounts of energy. A study by Cambridge University predicted the blockchain is highly unsustainable from an environmental viewpoint since the amount of energy used is relatively high. Therefore, trading in NFTs and other blockchain-based assets isn’t necessarily an environmentally friendly process.

3. Piracy

Just because you own the NFT of a digital asset doesn’t mean you control the asset. You simply have a token of authenticity. Owning a digital asset is like owning a piece of art. It can be copied and pasted, GIFs reposted thousands of times, and videos posted on various websites. Remember, the digital format can be manipulated and pirated by hook or crook. Despite the security of NFT technology, many exchanges and platforms are vulnerable to cyberattacks. Stolen NFTs have been reported in several cases of cyber breaches.

4. No Revenue Generation

While we associate NFTs with monetary gains and losses, the tokens themselves do not generate any income. They are nothing like your traditional financial instruments like stocks, securities, bonds, real estate, or even cryptocurrencies. Hence, NFT owners do not receive any interest, dividends, or rent. The only way an NFT investment appreciates is when the NFT appreciates. Just like an art piece or antiques. But it is not a stable source of income, which one should heed before investing in these tokens.

5. NFTs Can’t be Used for Physical Art

Scrolls and physical artifacts are unique in that they cannot be digitized—a quality that often sets them apart from digital art. While you can’t take a digital painting with you everywhere you go, a physical painting provides a one-of-a-kind experience that you can’t get from a screen. Unfortunately, a non-fungible token would be limited to specific areas only. This sums up the entire use when there is no regulatory authority to manage it, such as governments or banks.

6. The NFT market is unpredictable

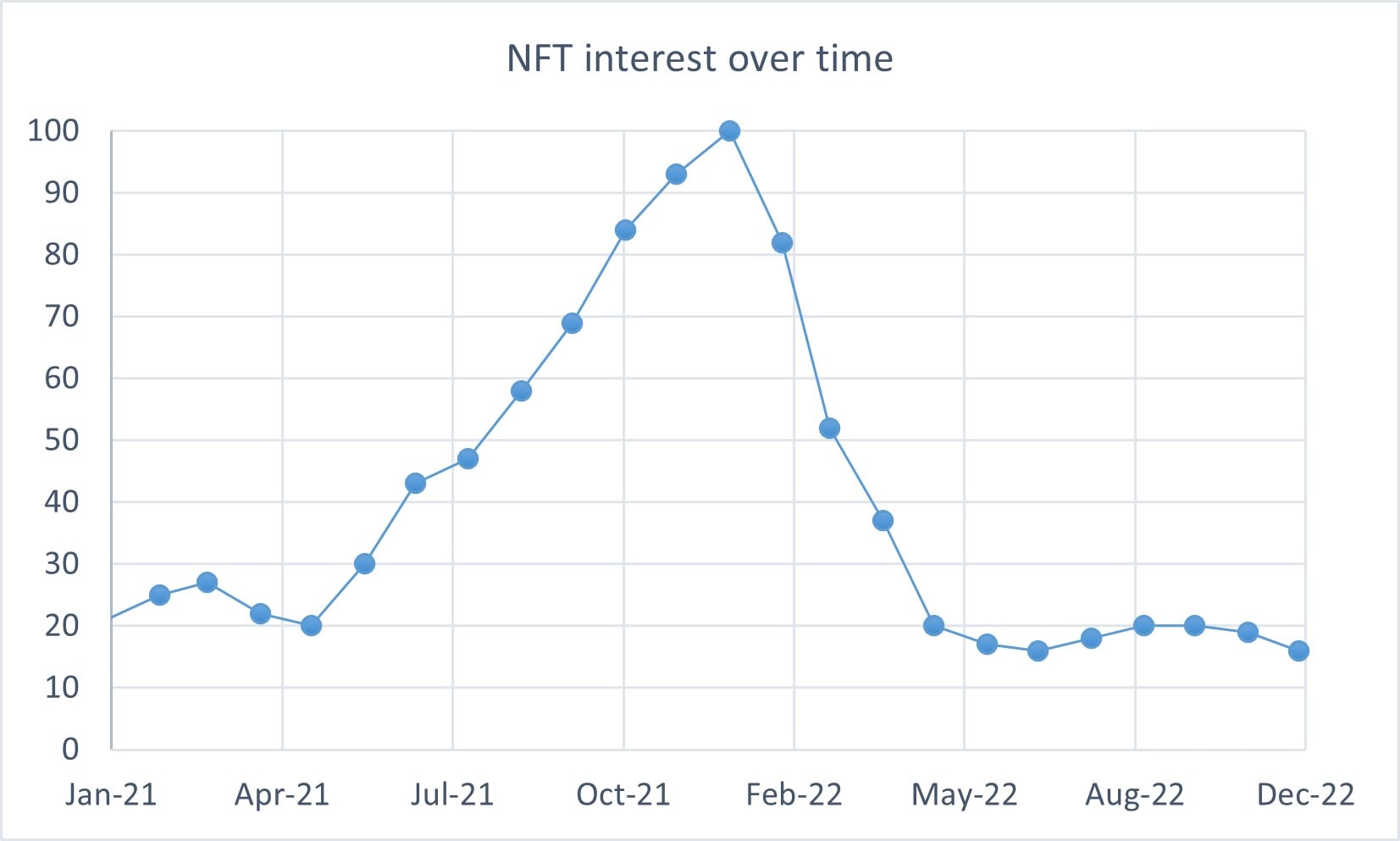

Just like the crypto market, NFT is also something that can change in value overnight. Not by a simple fraction, but more than 50% sometimes. The interest in NFTs has grown drastically within a span of few months, and now, it is nowhere near where it used to be. The below image shows the NFT interest over time.

As you can see, the interest peaked by the end of 2021. Since then, the NFT market has been collapsing. A lot of people lost money. Very few made profits. So, it is up to you whether you want to invest in something so volatile.